nevada estate tax return

Since Nevada does not collect an income tax on individuals you are not required to file a NV State Income Tax Return. I am a small business owner and my revenue is less than 4000000.

Indy Explains What S Going On With Clark County S Property Tax Caps The Nevada Independent

Current Bank Excise Tax Return Effective July 1 2011 An excise tax on each bank at the rate of 1750 for each branch office in excess of one maintained by the bank in each county in this.

. The personal representative of every estate subject to the tax imposed by NRS 375A100 who is required to file a federal estate tax return shall file with the Department on or before the federal. With it you can manage your own tax account anytime anywhere and. Microsoft Word - TPI-01 10 Nevada Estate Tax Instructionsdoc Author.

Inheritance tax from another state Even though Nevada does not levy an inheritance tax if you inherit an estate from someone living in a state that does have an. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The types of taxes a deceased taxpayers estate.

This QA addresses whether a jurisdiction has any estate tax or other similar taxes imposed at death and for jurisdictions currently imposing a state estate tax includes an overview of the. The estate tax is on the estate of the deceased person before the inheritance gets disbursed. File My Federal Return.

See what makes us different. The easiest way to manage your business tax filings with the Nevada Department of Taxation. Log In or Sign Up to get started with managing your business.

Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. Tobacco taxes cost 180 per pack of 20 cigarettes or nine cents per cigarette. This is an increase of 18 of 1 percent on the sale of all tangible personal property that.

As stated Nevada does not have an estate tax. If your Nevada gross revenue during a taxable year is over 4000000 you are required to file a Commerce Tax return. Ad Download or Email IRS 1041 More Fillable Forms Try for Free Now.

We dont make judgments or prescribe specific policies. However you may need to prepare and e-file a 2021 Federal Income Tax. Estate tax planning in Nevada considers additional deductions that can be taken for qualified charitable deductions as well as administrative and legal costs involved in settling the.

It gets paid out of the estates funds. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

It is a very friendly taxing state and collects substantial income from the gambling Industry. Smokers in Nevada pay the 23rd-highest cigarette tax in the US according to IGEN. NevadaTax is our online system for registering filing or paying many of the taxes administered by the Department.

Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid. Generally the estate tax return is due nine months after the date of death.

Nevada estate tax. Nevada Estate and Inheritance Tax Return Engagement Letter - 706 Find state-specific templates and documents on US Legal Forms the biggest online library of fillable legal templates. Nevada currently does not have an estate tax.

Nevada Tax Center. Nevada does not have state income tax.

Nevada Inheritance Laws What You Should Know

Nevada Inheritance Laws What You Should Know

Estate Tax Probate Estate Planning Attorneys In Las Vegas Nv

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Free Nevada Quit Claim Deed Form Pdf Word Eforms

It S Tax Season Will My Alimony Be Tax Deductible In 2021

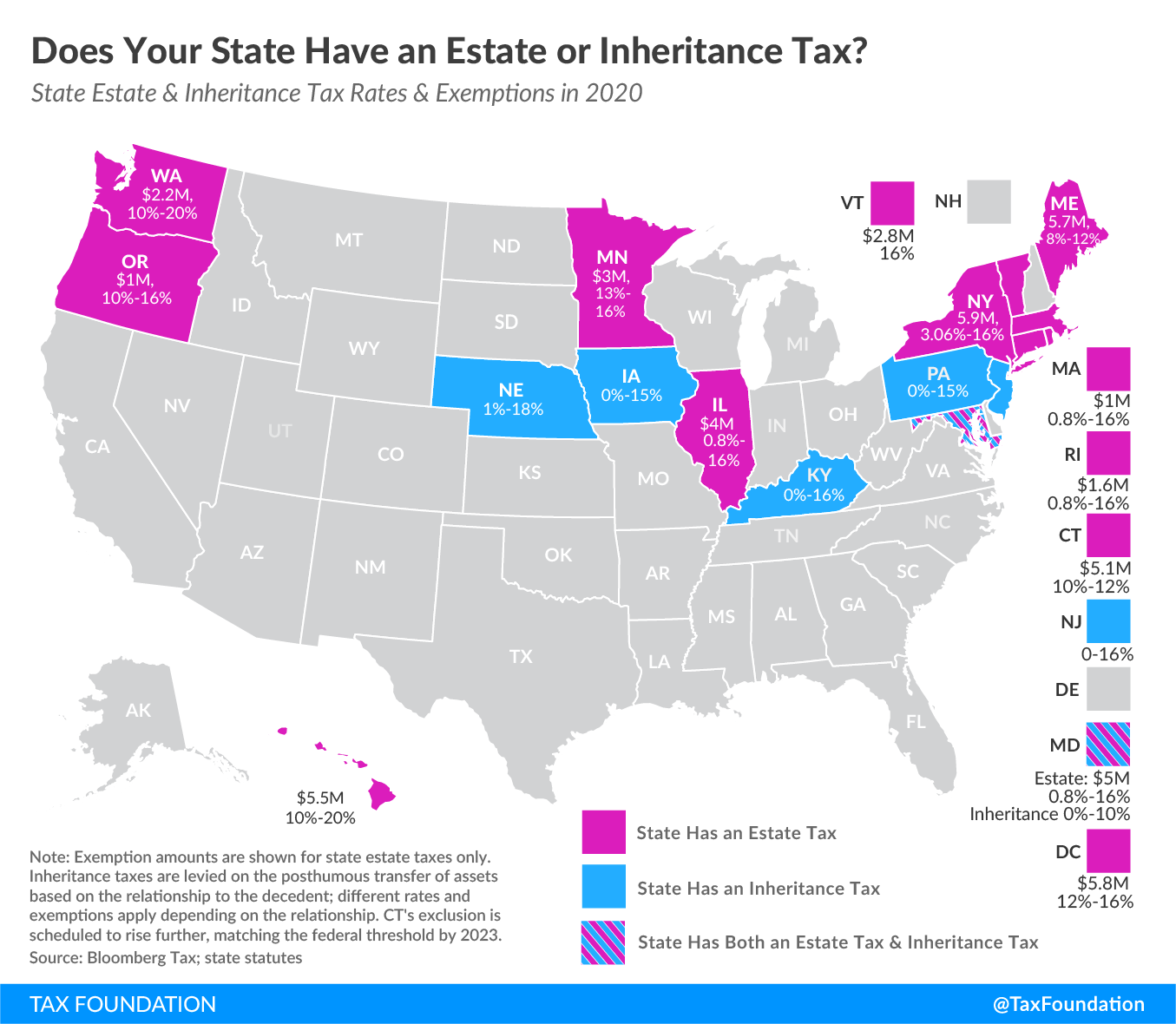

State Death Tax Hikes Loom Where Not To Die In 2021

State By State Estate And Inheritance Tax Rates Everplans

Nevada Trusts Safeguarding Personal Wealth Northern Trust

Nevada State Taxes Everything You Need To Know Gobankingrates

States With No Income Tax Map Florida Texas 7 Other States

Nevada Trust Law Companies Benefits Costs Pros Cons Taxes

Is Child Support Taxed In Nevada Half Price Lawyers

Nevada Estate Tax Everything You Need To Know Smartasset

Nevada Real Estate Transfer Taxes An In Depth Guide

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Filing Taxes For Deceased With No Estate H R Block